Nonetheless, you and your financial should make sure that the latest house youre to shop for is in appropriate reputation

FHA Minimum Property Conditions

To acquire a home which have a traditional financial implies that our home does not need to meet the strict standards other sorts of mortgage loans might require. It will take certain solutions, however they really should not be the kind of fixes or so extensive that it will stop you from providing financing.

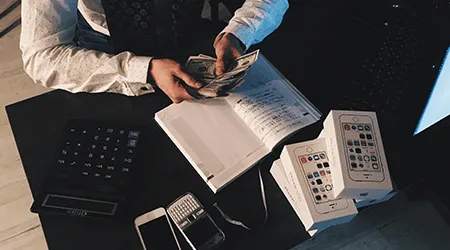

Old-fashioned mortgage loans normally require a down-payment away from 20% out of brand new appraised worth of our home, even though some conventional fund require lower than you to. Or even squeeze into a normal home loan, you are using an FHA or Virtual assistant mortgage, and this want less money down but have more strict laws and regulations in regards to the reputation of the property and you may possessions.

TL;DR (A long time; Didn't See)

In the event the an assessment shows biggest things such as a weak roof, non-performing utilities, mildew or direct paint, you'll likely need done repairs to continue to the traditional financing.

An appraisal, Not an examination

Even in the event using a traditional mortgage, the borrowed funds lender wants to guarantee our home is really worth the price you happen to be paying. The newest appraiser is actually acting as the fresh new attention of financial. Remember, an appraisal is not the just like a house assessment. A review try a bit more comprehensive.

House try appraised for the reputation. That doesn't mean things have to settle best doing work buy, however, there are still a few things that must definitely be into the a good buy. There was a time whenever loan providers out of antique financing sensed absolutely nothing over pest repairs, but today lenders much more cautious.

Exterior Family Possess

Property updates is the main factor into the determining a home value. The house can be neat and really-kept to provide a knowledgeable perception. Various other basis 's the age of the house.

Direct or flaking installment loans Oakland OK color could well be problems should your home are built just before 1978 when many types of home decorate contains direct. Things like cosmetic points and style commonly supposed to be within the assessment, however painting is flaking otherwise you can find openings in the new wall structure, which can be a challenge to have a keen appraiser. Of a lot loan providers will want brand new cracking decorate fixed ahead of issuing the fresh new financing. People gaps from inside the wall space or floor of the home can be fixed, and you can broken window might almost always should be repaired.

Appraisers often thought one safe practices issues prior to suggesting new household be provided with a traditional financing. A keen appraiser need things be fixed because the an ailment in advance of a loan is recognized. Roof troubles are several other red flag getting appraisers. Of numerous financial institutions need to know that a ceiling keeps no less than three-years of great functioning lifestyle kept inside.

Indoor House Have

Inside the house, a keen appraiser have a tendency to note the number of bedroom, should your heater and you may ac unit performs, in the event your devices is actually recent or updated incase you will find an excellent completed basement otherwise a garage.

Appraisers to possess old-fashioned finance may have some other conditions, but some tend to mention visible flaws. An excellent rusted gutter or a loose flooring or platform panel will get need to be fixed in advance of a loan is approved. Particular loan providers may need functioning cig sensors from inside the for each and every bedroom, even in the event it is not required by password. If there is people shape otherwise breaks regarding the structure, the appraiser may want to call in a specialist to check always the main cause.

Just what Should be Repaired

While the buyer, you can examine observe there clearly was a safe handrail for tips and you may stairwells. People increased porches need a safe railing, while second-floor porches must have a secure doorway.

The tools is going to be in an effective functioning acquisition. When the you can find any plumbing troubles, roof leaks or marks, ensure that the vendor possess him or her repaired. Check the structure, roof and basis to own splits. Read the base to make certain no h2o was dripping thanks to it.

Fuel is a common reason a bank cannot render a great Va appraisal. Even when you are utilizing a traditional loan, you ought to ensure that the electric system provides adequate power to save the home's electric products running smoothly.

A negotiating Processor chip

If the a house appraises at under the new asking price, as there are one thing substantially wrong on the family, your because buyer could possibly play with you to definitely looking for just like the a reason for the vendor to lower the new price tag. If you need Doing it yourself family programs, a normal mortgage can get allow you to get a house from inside the less-than-prime reputation to get more worth.